Instructions for entering your offering information.

This is the first step to complete a capital raise with investor IRA dollars. To best support you through this onboarding process, we have provided a set of written instructions and definitions of terms below. If you prefer to watch a video and listen to these instructions, we've recorded one here:

Bank Note: Please note that Alto does not currently support payments to international banks. 🚧

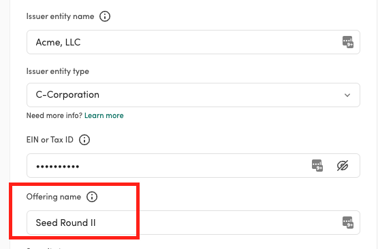

Step 1: Enter the issuer entity name: The name of the legal entity selling securities to your investors. For example, Flexport or Sequoia Capital.

Step 2: Select the issuer entity type: This is the legal classification of the entity you are raising capital for. You will be asked to select one of the following types:

- C-Corporation (C-Corp): a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the entity (source).

- Limited Liability Company (LLC): a business structure that protects its owners from personal responsibility for its debts or liabilities (source).

- Limited Partnership (LP): a partnership made up of two or more partners (source).

- Non-US Entity: any entity that is not formed in the United States. (source).

Step 3 (optional) - Enter the EIN or tax ID: A nine-digit identification number issued by the IRS.

Step 4: Enter the offering name: The name of the securities offering you are selling to investors. For example, Seed / Series A / Growth Round or Sequoia Bio Fund VI.

Step 5: Select the security type: This is the type of securities you are issuing to investors. You will be asked to select one of the following types:

- Shares: units of equity ownership in a company (source).

- SAFE: a simple agreement for future equity is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment (source).

- Units: a combination of securities or types of securities packaged together and sold as one (source).

- Membership interest: an investor’s ownership stake in an LLC (source).

- Partnership interest: a partner’s share of the profits and losses of a limited partnership (source).

- Promissory note (1/2) - convertible note: a form of short-term debt that converts into equity, typically in conjunction with a future financing round (source).

- Promissory note (2/2) - other: a debt instrument that contains a written promise by one party to pay another party a definite sum of money (source).

- Crowd SAFE: an adapted version of the SAFE designed specifically to work for investment campaigns accepting hundreds or even thousands of investors (source).

- Crowd SDA: a Simple Debt Agreement. A way to raise debt capital from a crowd (source).

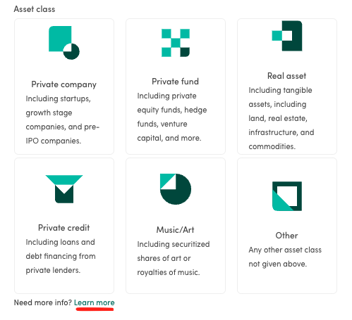

Step 6: Select the asset type: This is how you would classify the asset your investors are investing in. You will be asked to select one of the following types:

- Private company:

- Early stage / startup: a company in the early stages of operations (source).

- Growth stage: a venture-backed startup that is at a rapid period of expansion and growth (source).

- Late stage / pre-IPO: a larger company with a well-known product and strong market presence, potentially leading up to an IPO (source).

- Private fund:

- Hedge fund: actively managed investment funds, typically investing in public markets through a variety of strategies (source).

- Private equity fund: investment partnerships that buy and manage companies before selling them (source).

- Venture capital: funds that provide financing to startup companies (source).

- Real estate fund: professionally managed funds that invest directly in real estate properties (source).

- Crypto fund: A crypto fund that invests exclusively in crypto assets (source).

- Real asset:

- Investment property: a real estate property purchased with the intention of earning a return on the investment either through rental income, the future resale of the property, or both (source).

- Land: refer to real estate or property, minus buildings and equipment, which is designated by fixed spatial boundaries (source).

- Mineral rights: ownership claims against the natural resources located beneath a plot of land (source).

- Infrastructure: the basic physical systems of a business, region, or nation and often involves the production of public goods or production processes (source).

- Commodities: a basic good used in commerce that is interchangeable with other goods of the same type (source).

- Wine: an alternative investment in wine (source).

- Private credit:

- Individual loan: Money borrowed from a lender by an individual (source).

- Music / Art:

Step 7: Select yes/no if your offering allows accredited investors: Need more information on what an accredited investor is? See the SEC’s definition here.

Step 8: Select yes/no if the offering has capital calls: Select yes if your offering asks investors to pay a portion of their investment up front, and have the remaining balance held to be used at a later date.

Need more help? Check out our capital calls guide here.

Step 9 (optional) - Enter any additional funding details: Enter any additional funding information as it relates to this specific offering. Examples include:

- The deadline for capital raises

- If this is a rolling fund.

- If there are monthly subscriptions with funding and paperwork due by the 1st of each month.

- If there are quarterly redemptions

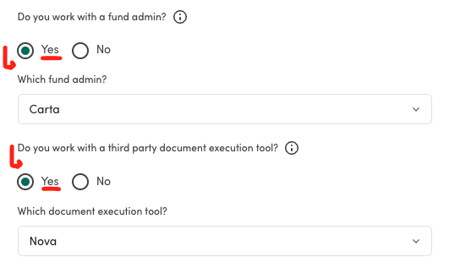

Step 10 - Select yes/no if work with a fund administrator:

A fund administrator is a third-party service that handles a venture fund’s accounting, LP reporting, asset valuation, capital calls, and capital distributions (source).

Step 11 - Select yes/no if you utilize a third-party subscription tool:

Select yes if you leverage software to help investors complete subscription documents.

If you select yes, you’ll be asked to select the subscription tool from a dropdown list or enter the tool within the text field if it’s not an available option.