Please follow the steps below to request a one-time IRA distribution.

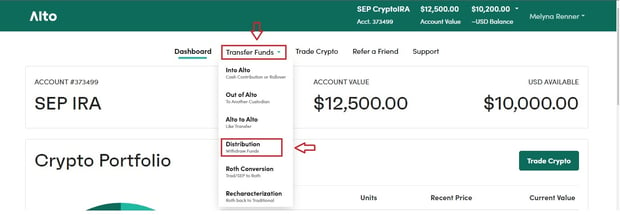

- Select Transfer Funds at the top of the page

- Select Distribution from the drop-down menu

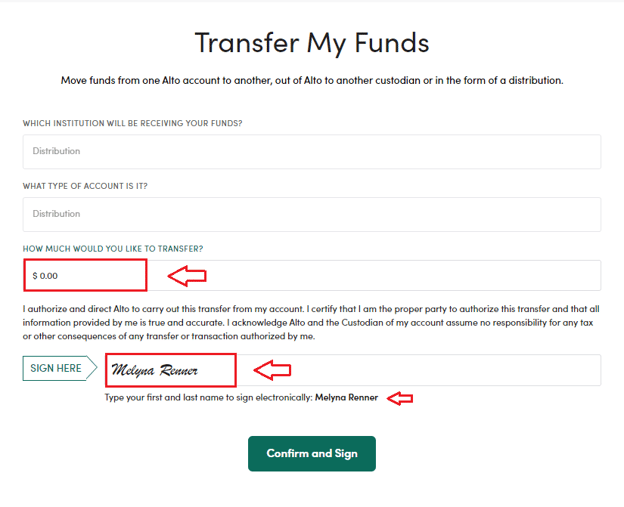

- Enter the amount

- E-sign your name exactly as it displays

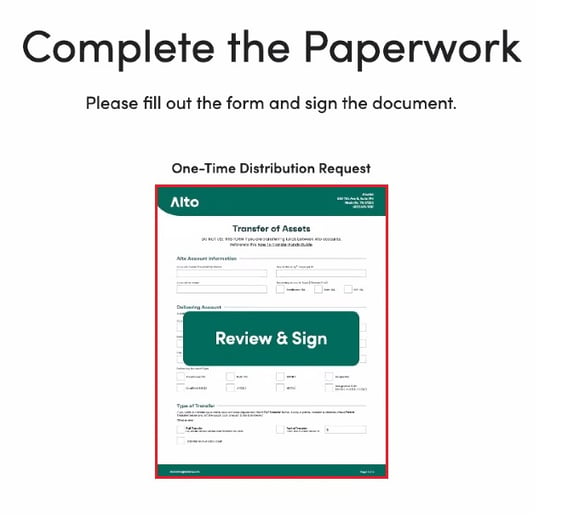

- Click Review & Sign to enter the distribution form

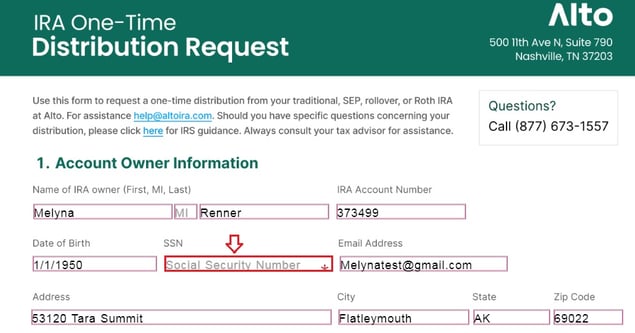

- Enter your SSN

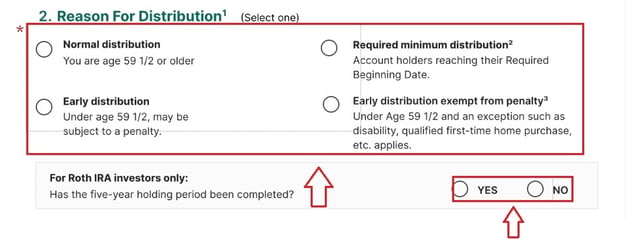

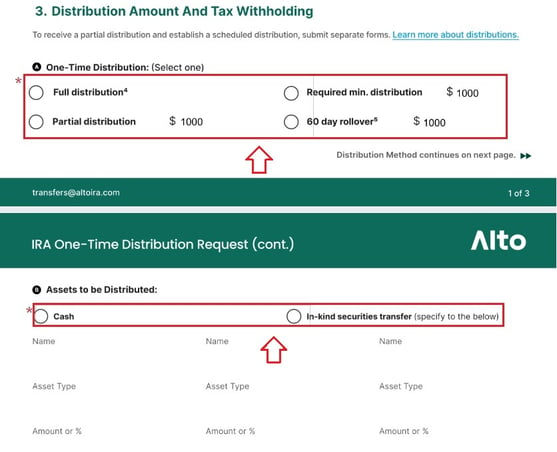

- For the remainder of the form, only one selection should be made for each question

Note: In-kind distributions do not apply to crypto assets. Cryptocurrencies must be sold and distributed as cash.

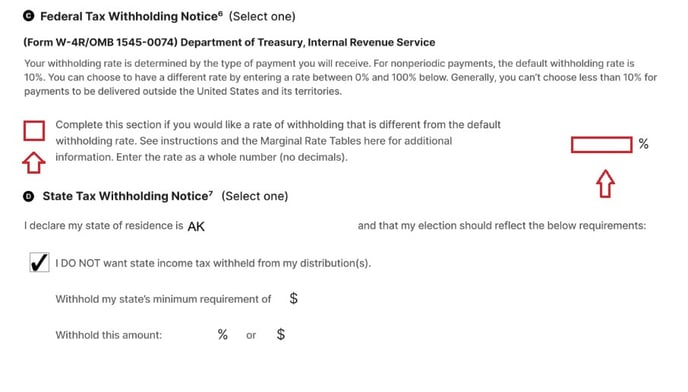

- Elect Federal tax withholding (please fill in a range from 0% to 100%)

- Note: If no election is made the default tax withholding rate is 10%. AltoIRA does not withhold state taxes at this time.

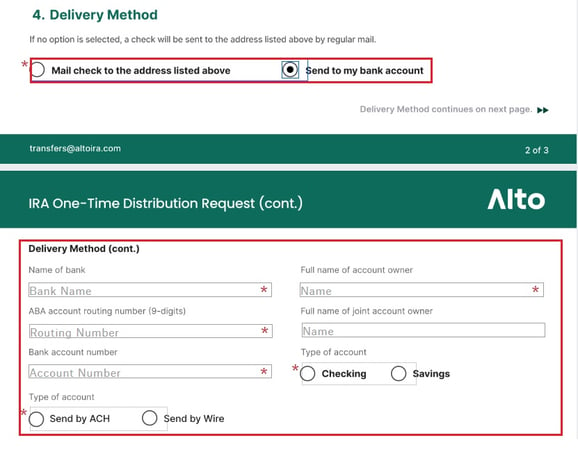

- Select delivery method

- Once the document has been signed and submitted, your request will be within 2-4 business days.

If you have any questions, please reach out to us:

- Phone: 877-673-1557

- Email: transfers@altoira.com

- Contact Us Form